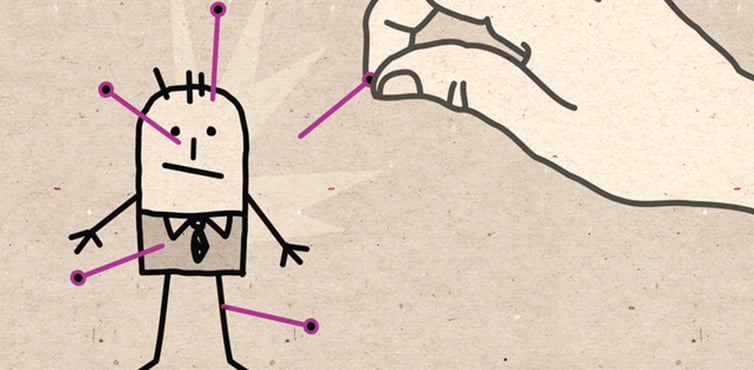

Is your business feeling random pains in unexpected places? Are you experiencing struggle in your organization where there should be ease? You may have unwittingly given over the magic power to damage your business. Like handing a voodoo doll to your clients, a lack of on-time payments can cause discomfort and suffering.

Here's where your clients are "sticking it to you" and how to make it stop.

A Pain in the Business

Every business has growing pains and challenges to overcome. These are normal and expected and offer clues that structure is needed. A proactive approach to business organization is helpful to prevent handing over your power to your clients. Yes, client needs are important to your business but that doesn't mean that your own needs go unmet.

When clients don't pay their invoices on time, your business needs become business pains.

You may experience:

- Sudden decrease in funds to pay vendors, rent, and other office necessities

- Loss of employees who are unable to be paid on time

- Headaches as you prepare for tax time and realize you're low on funds

- Hemorrhaging of time and resources trying to recover past due payments

Break the Client Curse

The best way to break the curse of client late payments is to steal back that voodoo doll. Set your business up for success by organizing your invoicing and accounts receivable process.

Write it down. One of your best defenses against client late payments is a contract. Include payment terms, payment methods, expected scope of work, deadlines, and late payment policy.

Plan the date. Invoicing should be done on a regular basis, even if you have to add a reminder to your calendar. This planned time should be spent invoicing and checking for invoices that haven't been paid or are coming due.

Make contact. Once you're aware of invoices that are about to be late or haven't been paid, follow up with your clients as soon as possible. Be friendly but firm when communicating with your clients so they understand the urgency of on-time payments.

Get ER for your A/R

Structured procedures for accounts receivable are helpful to stop the loss of resources to your business. If it's already overwhelming and your business could use some help, it may be time to call in some expertise.

Enterprise Recovery offers three options to help with accounts receivable recovery:

- Accounts Receivable Clean Up: We represent your business and contact clients on your behalf to recover unpaid invoices. We guide you to build best practices for accounting and identify repeat offending clients.

- Bad Debt Collections: If you've written off client accounts as uncollectible, we can still help. As we attempt the collections process, there is no charge to you unless we recover any or all of the account.

- Legal Services: We have an in-house legal team to help negotiate a settlement. No need to pay for a lawyer with Enterprise Recovery on your side.

Are your clients using voodoo on your business?

Instead of allowing your clients to stick it where it hurts, consider your options. You do have a right to be paid on time. You do owe it to your business to break the curse and recover overdue accounts. If you need more information on what the best commercial collection agency should do for your business, click the green button below to download a free guide.