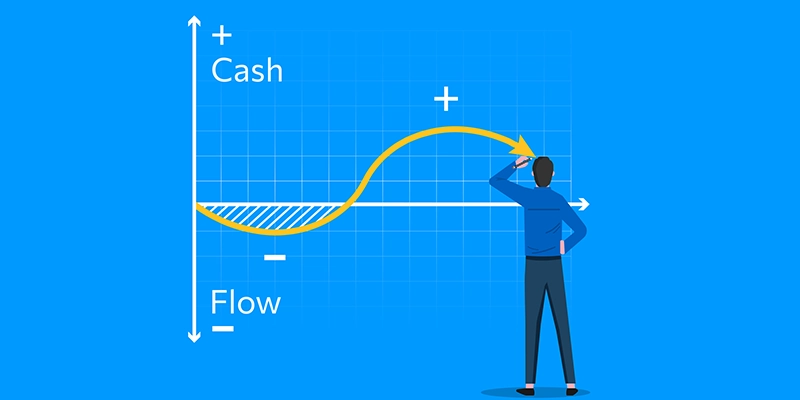

By mastering cash flow management, businesses can avoid the pitfalls of cash shortages, which can lead to operational disruptions and missed opportunities. Optimizing working capital, a key component of cash flow management, can significantly enhance your business's ability to thrive in a competitive market.

It can be easy to get frustrated and make assumptions about why your invoices aren't being paid on time. The problem is that your frustration doesn't solve or prevent the situation from happening. After years of recovering delinquent debt for B2B clients, we've identified many reasons behind late or unpaid invoices.

Read on to discover the reasons behind unpaid invoices and how to tackle them effectively.

As accounts receivable (A/R) become delinquent, your business expenses could fall behind. With every late-paying client, cash flow for payroll, rent, or other vendors falls short, threatening your company's bottom line and growth. The effectiveness of your A/R department may be one of the most important measurements to determine the success of your business.

Mastering accounts receivable and invoice management is vital for B2B companies to ensure smooth cash flow and sustainable growth.

Failing to manage accounts receivable can result in delayed payments, hindering the ability to pay bills, meet payroll, and reinvest in your business. For freelancers and small businesses especially, it is imperative to prioritize strategies that will help keep accounts receivable in check and improve cash flow to meet expenses.

Boost the financial stability of your freelance or small business by mastering accounts receivable management for a proactive cash flow.

Outstanding invoices can be devastating to businesses of any size. The ripple effects of unpaid invoices can lead to cash flow problems, making it difficult to cover operational costs, pay employees, or invest in growth opportunities. Small businesses often lack the financial cushion that larger enterprises might have. However, even large corporations are not immune; accumulating unpaid invoices can disrupt financial planning and hinder strategic initiatives.

Unlock the secrets to efficient invoice management and ensure timely payments with these expert techniques.

Certain qualifications and skills can make a difference in your business's financial success. Consider the following traits for your A/R specialist job description and hire someone who will ensure your financial records are solid and your clients pay on time.

Here are some key qualities and skills to look for in an accounts receivable specialist.

Credit managers can help your business by ensuring the smooth functioning of credit operations. They are responsible for assessing the creditworthiness of potential clients and managing credit limits to prevent late payments and minimize financial risks. They also play a vital role in collecting accounts receivable and bad debt.

By understanding the role of a credit manager in your business, you can effectively utilize their expertise to optimize cash flow and maintain a healthy financial position.

Are you finding it challenging to get your clients to pay their invoices on time? Delays can be frustrating, impacting your cash flow and potentially causing financial strain. Several effective strategies can be implemented to streamline your payment process and ensure timely payments from your clients.

Check out these five effective strategies to improve your payment process and boost your cash flow.

When selecting an outsourcing partner for your accounts receivable needs, it is essential to explore a variety of key factors to ensure a successful partnership. Understanding your business needs is only the first step in this process. By clearly identifying your goals, objectives, and the level of support required, you can better evaluate potential partners that align with your specific requirements.

Learn more in this guide when choosing and outsourcing to an accounts receivable partner.

Accounts receivable is an essential aspect of any business's financial management. It refers to outstanding payments owed to your company for goods or services provided on credit or with an agreement that payment is owed. By allowing your business clients to defer payment, your company can attract more clients and increase sales.

Managing A/R effectively, however, is crucial to maintain a healthy cash flow.