Outsourcing accounts receivable and collections is a strategic decision that can benefit businesses. By partnering with a collection agency, businesses can offload the time-consuming task of chasing unpaid invoices, allowing them to focus on their core operations.

Recent Posts

The tech industry is known for its rapid growth and innovation but faces unique challenges regarding debt collection and non-paying clients. Understanding the intricacies of debt collection in this sector is essential for companies to recover payments and maintain financial stability.

Learn more about the complexities of debt collection within the tech industry and the strategies for successful payment recovery.

In today's competitive business landscape, it's important to manage late payments while upholding positive client relationships. Use the following techniques to navigate the delicate balance of recovering outstanding debts while maintaining trust and loyalty with your clients.

Discover ethical collection practices to help recover late payments while maintaining positive client relationships.

Is your business struggling with unpaid invoices or clients not paying on time? Many companies often turn to professional debt collection agencies for assistance when this happens. Before you hand over your delinquent accounts to a collection agency, it's important to understand their role and how they can help your business.

Learn how to effectively prepare your business for working with a debt collection agency to recover outstanding payments.

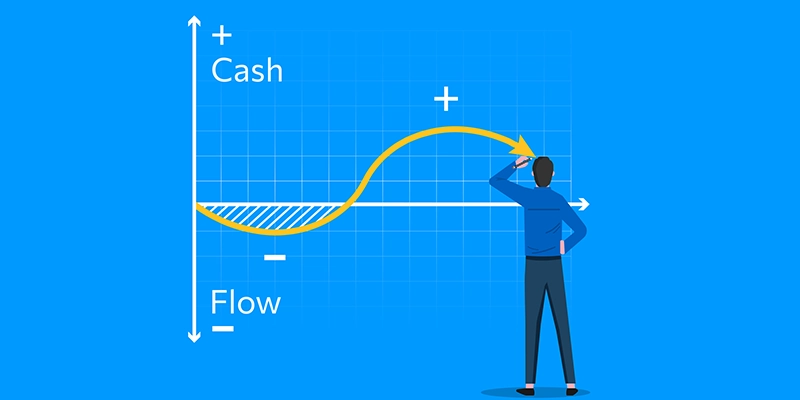

Are you finding it challenging to get your clients to pay their invoices on time? Delays can be frustrating, impacting your cash flow and potentially causing financial strain. Several effective strategies can be implemented to streamline your payment process and ensure timely payments from your clients.

Check out these five effective strategies to improve your payment process and boost your cash flow.

When selecting an outsourcing partner for your accounts receivable needs, it is essential to explore a variety of key factors to ensure a successful partnership. Understanding your business needs is only the first step in this process. By clearly identifying your goals, objectives, and the level of support required, you can better evaluate potential partners that align with your specific requirements.

Learn more in this guide when choosing and outsourcing to an accounts receivable partner.

Accounts receivable is an essential aspect of any business's financial management. It refers to outstanding payments owed to your company for goods or services provided on credit or with an agreement that payment is owed. By allowing your business clients to defer payment, your company can attract more clients and increase sales.

Managing A/R effectively, however, is crucial to maintain a healthy cash flow.

Read further to gain a better understanding of how accounts receivable management can significantly improve your cash flow.

Complex tax questions can be especially confusing for small businesses, freelancers, or startup companies. It's important that your business's financial records are maintained with integrity and organization. If you're a one-person department or temporarily taking on the accounting role, it's natural to have some questions and uncertainties.

Avoid common accounting mistakes and ensure a smooth tax season with these best practices.

While much of your budget planning was likely done in the fourth quarter, it's never too late to set your business up for success in the new year. Financial planning is valuable at any time - whether you're evaluating your business investments or measuring why your cash flow is slow.

Read further to discover essential financial planning tips for business owners to ensure long-term success and growth.

When clients fail to pay their invoices on time, it can negatively impact your cash flow and harm your business in various ways. Maintaining a healthy cash flow is crucial for the success of your business, so it is essential to address any issues with late payments promptly and find effective solutions to ensure a steady and stable financial foundation.