Once you've agreed to a contract and payment terms, the assumption is that you can send an invoice and the client will pay. Disappointment sets in when the payment due date comes and there's no payment from your client. This can be especially frustrating to your sales team, if it's a new client who seems to have reneged on the deal. You don't have to lose hope.

Accounts receivable management is defined as the practice of collecting money that is owed after extending credit for a product or service. When you invoice a client for a product or service, it creates a balance in accounts receivable. When issuing credit to a client, what's owed on that credit is an accounts receivable balance. When your client pays a monthly retainer, there's a monthly accounts receivable balance. Collecting accounts receivable is important to keep your organization going.

Here are six tips to improve the process of accounts receivable collections.

Calculating your business' accounts receivable turnover is one of the most telling year-end accounting best practices. This ratio will offer a huge clue about your business successes and near-misses in extending business credit and collecting on what's owed. The value of this number will help determine weaknesses in your accounts receivable processes so improvements can be made.

Read on to learn more about A/R turnover, how to calculate the ratio, and what procedures can help increase accounts receivable turnover ratio.

As 2017 comes to a close, we find ourselves in the thick of the holidays. We may be wrapping up year end accounting, buying last minute gifts for clients or hoping the boss remembers to say thank you to the accounting department. Either way, we're counting just a few more working days before the holiday weekend. In the spirit of giving back, we're offering the top 10 most popular business and accounting blog posts of 2017.

While accounting may not appear as glamorous as, perhaps, your sales department, they shouldn't be taken for granted. They're likely working hard to close out the end of the year, keeping away IRS audits as well as ensuring that you have enough money to pay employees, vendors, and overhead. If you haven't already, you might offer some appreciation during the holidays.

Here are the best holiday gift ideas for your accounting department.

When building out contracts or proposals for clients, the simplest option is to create a standard agreement and use it every time. Each of your clients, however, may require a different financial arrangement. Your written contract is a binding agreement for services and payment and will protect your business. If every client paid on time, one set standard of payment terms would work fine. Unfortunately, not all clients pay in that timely manner.

Here's what to consider when establishing your B2B contract payment terms:

The holidays may put a strain on you as an individual but end-of-year accounts receivable follow-up could put a strain on your business. It can be challenging to review overdue invoices and the potential of bad debt write offs and stay in the giving spirit. If cash flow is strained, a business owner may feel resentful of those clients who still owe on invoices. Treating your clients well, however, is necessary for retaining those relationships. B2B sales cycles take longer so your clients are important, even when their invoices are unpaid.

Here are 5 best practices for treating your clients well during the holidays, even when they owe you money.

A recent global study revealed that American businesses get their invoices paid in an average of 23.5 days compared to businesses around the world. Small to medium businesses in Canada, the Czech Republic, Germany, Hong Kong, France, Ireland, the Netherlands, the UK, Singapore, and Poland were also surveyed. Business invoices in France and Singapore were paid on average in 45 days. Comparatively, these figures are positive but late payments are still a problem in the United States.

What challenges are U.S. small to medium businesses facing when attempting to get their invoices paid faster?

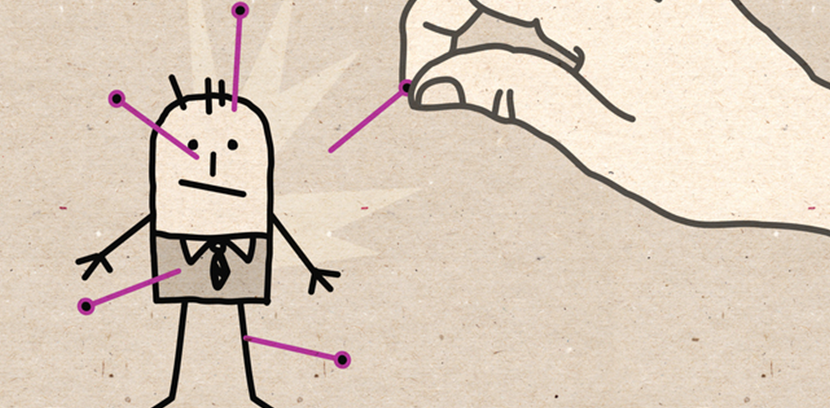

Is your business feeling random pains in unexpected places? Are you experiencing struggle in your organization where there should be ease? You may have unwittingly given over the magic power to damage your business. Like handing a voodoo doll to your clients, a lack of on-time payments can cause discomfort and suffering.

Here's where your clients are "sticking it to you" and how to make it stop.

Consider a typical cash collection cycle timeline:

- After a sale, an invoice is generated within a few days.

- The invoice delivery time could be another 1 to 3 days depending on the delivery method.

- An average invoice due date is 30 days.

- Payments by check and mail could take another 3 - 5 days.

If there are no glitches in the process, it may take more than 30 days to collect on a sale. If there is pushback on an invoice or the client isn't paying on time, the cash collection cycle could affect your business' cash flow, your ability to pay your own bills on time, including employees, and potentially damage the credit-worthiness of your own business. While shortening the collections process is ideal, increasing cash collections is also helpful.