So you've decided to take the plunge into entrepreneurship - 🙌Congratulations📣! Perhaps you're breaking away from an established business with a new idea or you're trying the freelance life. If you're feeling a bit unsteady, it's perfectly normal. Now's the time of frenzied activity and some of that involves rearranging your life. The good news is that you can build a solid foundation right now so that you're off to a great start.

Recent Posts

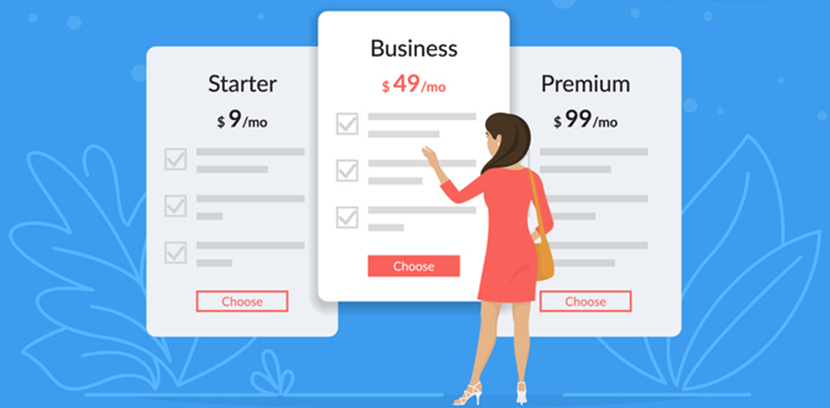

Subscription based billing is when services are billed on a recurrent basis. Examples of subscription services include website hosting, software, consistent access to published content, apps, music or other digital information. From a B2B standpoint, your business likely sells a service or software to another business and bills them monthly for access. This billing model brings in recurring revenue that your business can depend on.

Here's how to ensure that your subscribers keep paying their monthly bills.

Collecting on your accounts is part of normal, healthy accounts receivable management. When invoices or accounts aren't paid on time, however, your business should have a documented process for collections. Your payment terms and collections policy will be clearly stated on your contract agreements and on your invoices.

Within this post are best practices for contacting your accounts, when, how often and by what means. Read more to build out a collections checklist and workflow for debt collections.

Here's a Collections Checklist & Workflow for Delinquent Accounts

If your business keeps its customers happy, your profits could increase. In fact, research shows that a 5% increase in customer retention could lead to a 25 - 95% increase in company revenue. It's more costly to acquire a new customer than to keep an existing one. Think about what your business' customer retention rate measures:

- Your success at attracting and acquiring clients

- Your success at keeping those clients

- Your success at building loyal fans who will likely recommend you to others

For your consideration, here are client management strategies to increase your customer retention rate.

You might feel a bit uneasy when you hear the term "Debt Collection". It could conjure memories of unwanted phone calls or uncomfortable conversations about money. You may be thinking of Consumer debt collections. However there are differences between Consumer and Commercial collections:

-

Commercial debt collections, or business-to-business (B2B) collections, is used by businesses who sell or work with other businesses. Examples include creative agencies, consulting, manufacturing and freelance writing.

-

Consumer debt collections refers to businesses who work with consumers - such as retail, utility companies, healthcare - and is used to collect when consumers owe money.

Read more to learn about commercial debt collection, regulations around the process and if it can work for your business.

If your business struggles regularly with cash flow, there could be a number of reasons why. It may be internal processes that aren't being followed or aren't working. It may be external reasons such as the market or something else altogether. In order to make any changes, you first have to determine the root cause. Instead of scratching your head and getting more stressed...

Answer these questions to address the cash flow challenges of your business.

Nothing is more frustrating to a business owner than delinquent customer accounts. Delinquent accounts and unpaid invoices means lack of cash, strained client relationships, added stress and more. Unfortunately, according to a recent survey, more than 80% of small business invoices are 30 days past due.

To avoid becoming part of the rising statistics, follow these 3 simple steps.

Whether you're a freelancer, small or growing business, the internet can be helpful or overwhelming when it comes to business advice. Accounting and accounts receivable terminology can also be challenging, especially if you're the only person responsible for your company's finances or if you're growing your accounting department. There's no need to look further because we've done much the work for you.

Here are free B2B accounting templates and resources.

It's that time of year where the office seems to be a little quieter. Running a business during this time can be a challenge because there's a continual rotation of your colleagues who are out of office on summer vacations. You may have not given much thought to how summer affects your cash flow. Your A/R department may be thin and your clients' accounts payable contacts may be on vacation too.

Summer vacations can affect invoicing, accounts receivable and collections.

Here's how to make sure you still have working capital through the fall...

The short answer is YES!

If you're not already charging your B2B customers late fees on unpaid invoices, you should be! You may be concerned that a late fee could be damaging to your business relationship but in fact, it establishes you as a legitimate business owner.